Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

01 introduction to basic knowledge

1. Basic knowledge

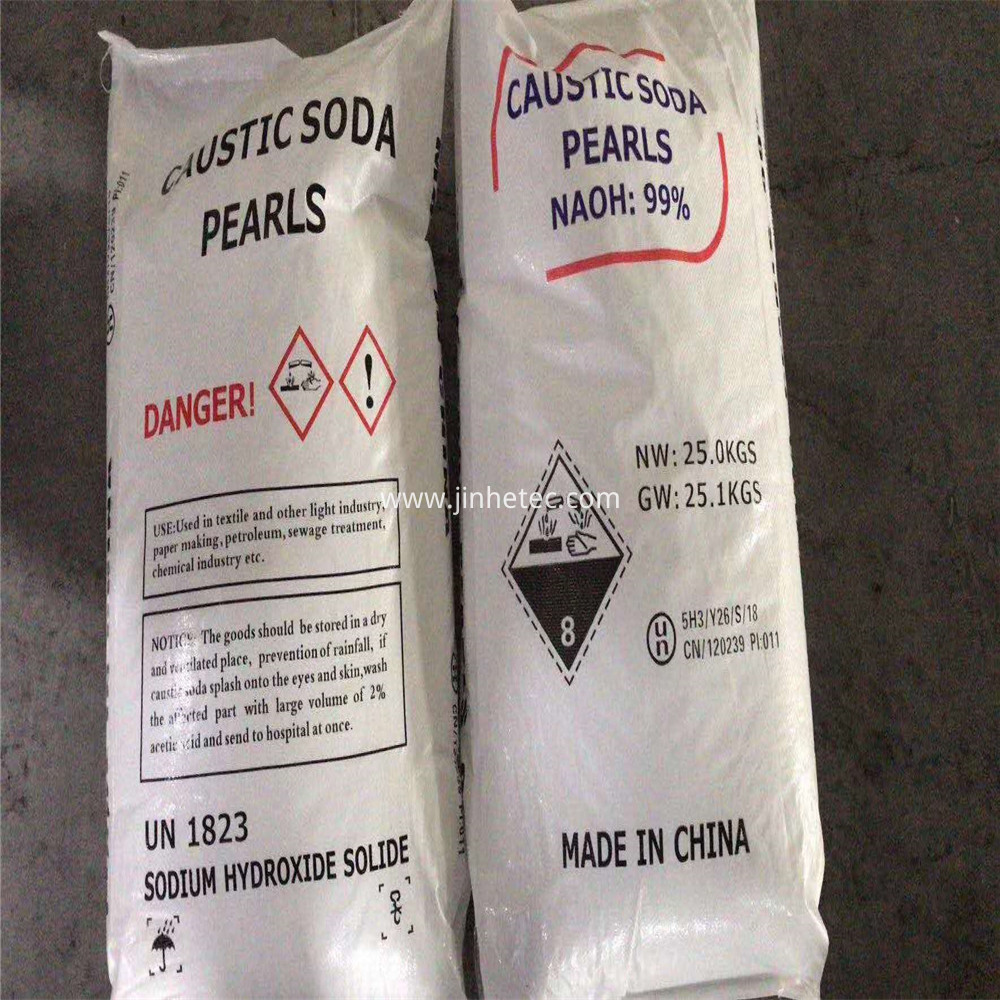

The scientific name of Caustic Soda is sodium hydroxide. The chemical formula is NaOH, commonly known as caustic soda and caustic soda. It is a strong alkali with strong corrosivity. It is white crystal at room temperature. It is easily soluble in water (exothermic when soluble in water) and forms an alkaline solution. In addition, it is deliquescent, easy to absorb water vapor in the air, deliquescent and deteriorate by absorbing carbon dioxide. It is a basic chemical raw material of the national economy. It is one of the two bases of "three acids and two bases" together with soda ash.

The existing forms of caustic soda are generally divided into liquid alkali and solid alkali. According to the mass fraction of sodium hydroxide, it can be divided into 30% liquid alkali, 32% liquid alkali, 45% liquid alkali, 50% liquid alkali, 73% solid alkali, 95% solid alkali, 96% solid alkali, 99% solid alkali, 99.5% solid alkali and other products. Solid alkali can be divided into barreled solid alkali, flake alkali and granular alkali. China's solid alkali market is dominated by flake alkali. The main reason is that flake alkali has the advantages of simple production process, low production cost, many application scenarios, large market demand and so on.

Caustic soda is an important basic chemical raw material, which is widely used in chemical industry, pulp production and papermaking, printing and dyeing and chemical fiber, metallurgy, soap and Detergent, environmental protection and other industries of the national economy.

2. Production process

There are two production methods of caustic soda, one is chemical method or causticization method, and the other is electrolytic method. Due to the low purity and poor economic benefits of caustic soda prepared by causticization, only a few countries have small-scale production. At present, the production of caustic soda is mainly electrolytic method. The stability of caustic soda produced by electrolytic method is higher and the economy is higher than that of causticization method.

The main raw material of electrolytic method is raw salt, which has great advantages in supply stability and price compared with causticization method. According to the difference between electrolytic cell structure, electrolytic materials and diaphragm materials, electrolytic method is divided into diaphragm method, mercury method and ion exchange membrane method. Mercury method has been eliminated due to its great environmental pollution. In China, diaphragm method has been basically eliminated due to high energy consumption and low product quality. Only some manufacturers retain diaphragm alkali units to support their own downstream products and do not sell them. Ion exchange membrane technology is the mainstream production method in the world. Ion exchange membrane method is the main production method in the Chinese market, and the production capacity accounts for 99.65% of the total production capacity of caustic soda.

3. Upstream and downstream industrial chain

From the perspective of industrial chain, caustic soda, as a basic raw material, is one of the main products produced by chlor alkali enterprises. Its main raw materials are raw salt and electricity. The fluctuation range of raw salt price is limited, which has little impact on caustic soda price. The power price is relatively stable under the national macro-control, and can basically be regarded as a fixed variable. The downstream of caustic soda is mainly alumina, printing and dyeing, textile, papermaking and fine chemical industries.

In the chlor alkali plant, caustic soda and chlorine will be produced at the same time. Generally, 0.886 tons of chlorine will be produced at the same time when 1 ton of caustic soda is produced. Caustic soda and liquid chlorine are co produced, but their consumption fields are different, which determines that their demand can not be completely coordinated when they are produced or supplied at the same time. Therefore, there is a linkage relationship between the market prices of caustic soda and liquid chlorine.

02 global supply structure

1. Supply

In recent years, the growth rate of global caustic soda production capacity fluctuates between 4% and 6%. In 2012, the global caustic soda capacity expanded significantly, with a capacity growth rate of 9.42%, and the annual capacity increased by about 7.959 million tons. The reason for the large growth may be that from 2010 to 2011, the consumption demand of the world, especially China, the main caustic soda consumer, continued to expand, and the growth rate was at a historically high level respectively. Among them, the growth rate of China's consumption in 2011 was 14.88%. Since 2012, the growth of global caustic soda production capacity has slowed down. By the end of 2020, the global caustic soda production capacity has reached 99.959 million tons.

From the distribution of caustic soda production capacity in 2020, the global caustic soda production capacity is mainly concentrated in Asia, which accounts for about 62% of the global total production capacity, of which China accounts for the largest proportion, accounting for about 44% of the global production capacity. In addition to China, Japan and South Korea in Northeast Asia are also large countries with traditional caustic soda production capacity. According to the detailed data of 2019, the production capacity of Japan and South Korea in 2019 is 5 million tons and 2.2 million tons respectively. In recent years, the pattern of caustic soda production capacity in Asia has changed greatly. India's caustic soda production capacity has gradually increased, surpassing South Korea, with a production capacity of 3.96 million tons in 2019, ranking third among Asian countries.

2. Demand

Novel coronavirus pneumonia demand is widely seen in recent 10 years. The demand for global new crown pneumonia is reduced slightly in 2020, and the demand for caustic soda has increased year by year, but the growth rate has slowed down. From 2010 to 2012, the growth rate of caustic soda demand was at a high position, with an average growth rate of 5.65%. From the global demand data in 2020, the total demand of the global caustic soda market is 75.772 million tons, which is reduced compared with 79.209 million tons in 2019.

Specifically, the global demand for caustic soda is mainly concentrated in Asia, Europe and North America. At the same time, Asia is also the region with the fastest demand growth. By the end of 2020, the annual demand in Asia had reached 46.738 million tons, accounting for 61.68% of the total global demand, while the Asian demand was mainly concentrated in China, with an annual demand of 32.563 million tons.

The demand for caustic soda in Europe is close to that in North America. In 2020, the demand will be 11.621 million tons, accounting for about 15% of the total global demand. It is reported that the growth points of European demand are mainly concentrated in the fields of chemical industry, pulp and soap industry. The demand in North America also accounts for about 15% in 2020, which is mainly concentrated in the United States, and its main downstream is chemical industry, pulp, papermaking, etc. The growth rate of demand for caustic soda in Europe and the United States is relatively limited.

3. Import and export

The main export regions of caustic soda in the world are mostly distributed in regions with relatively concentrated production capacity, namely North America and Asia, with the United States and China as the main export countries. Based on the supply and demand data of caustic soda in recent 10 years, it can also be seen that the capacity of caustic soda in China and North America is relatively surplus. In 2020, the capacity surplus in China and North America will be about 1186000 tons and 1988000 tons; The net export volume was 1.05 million tons and 1.938 million tons respectively.

03 China Market Overview

1. Supply

From the global supply and demand data, it is not difficult to see that China is the world's largest country in terms of both supply and demand, accounting for more than 40% of the world. Therefore, while exploring global supply and demand, it is necessary to briefly describe China's caustic soda market.

Since 2010, the output and capacity of caustic soda in China have increased steadily. From 2011 to 2014, the growth rate was fast, in which the output growth rate remained above 10% on average, and the production capacity still had an average growth rate of about 6.75%; In 2015, affected by the supply side reform and environmental protection policies, the caustic soda industry chain industry was structurally adjusted, and the capacity and output of caustic soda showed negative growth month on month; After adjustment in 2015, the growth rate of production capacity and output is relatively stable from 2016 to 2020. Over the past 10 years, China's output has increased from 24.66 million tons in 2011 to 36.432 million tons in 2020, an increase of 47.7%; The production capacity is relatively stable, rising from 34.12 million tons in 2011 to 42.485 million tons, with an annual growth rate of about 3.59%.

In terms of caustic soda plants, by the end of 2020, the top 10 enterprises in China's caustic soda production capacity were Xinjiang Zhongtai, Wanhua chemical, Xinjiang Tianye, Shandong Xinfa, Shandong Dadi salinization, Shaanxi Beiyuan, Shandong Jinling, Dongying Huatai, Binhua group and Shanghai chlor alkali, with production capacity of 1.87 million tons, 1.56 million tons, 1.16 million tons, 1.13 million tons, 1.05 million tons, 900000 tons, 800000 tons 750000 tons, 720000 tons and 720000 tons. The average capacity of China's top 10 caustic soda enterprises is 1.066 million tons, and that of the world's top 10 caustic soda enterprises is 2.648 million tons. The scale of a single Chinese enterprise is 40% of that of the world. There is room for further improvement in the scale effect of caustic soda of domestic enterprises.

2. Demand

The downstream sector with the largest consumption of caustic soda in China is the alumina industry. In 2020, the demand for caustic soda will be about 11.039 million tons, accounting for about 31%; The demand for caustic soda in the chemical industry ranks second, accounting for about 14%, with a demand of about 4.986 million tons. In addition, the industries with an annual demand of more than 2 million tons of caustic soda in China mainly include printing and dyeing, chemical fiber, Water Treatment, medicine, light industry, etc.

According to the apparent consumption data of caustic soda in China in recent 10 years and some research data, the demand for caustic soda in alumina industry will increase from 9.179 million tons in 2105 to 11.039 million tons in 2020. The overall growth rate of alumina industry is about 4.05% per year. The growth rate of chemical fiber industry is relatively fast, with an average annual growth rate of about 7%.

3. Import and export

China is the main net exporter of caustic soda. In 2020, China exported 1154600 tons of caustic soda, while the import volume was only 43600 tons, and the net export volume reached 1111000 tons. Compared with the total demand, the import and export volume of China's caustic soda are small, which mainly plays a role in regulating the supply-demand balance of China's caustic soda market.

According to the import and export data of caustic soda in recent 10 years, China's import volume has increased significantly since 2018. In 2018, the import volume of caustic soda was 40900 tons, a year-on-year increase of about 270%; In 2019, the import of caustic soda was 69900 tons, an increase of 70% over 2018; Due to the epidemic situation in 2020, the import volume declined, but there are still 43600 tons, mainly due to the obvious rise in domestic prices after 2018 and the large inflow of foreign low-cost caustic soda.

In terms of export, China has always been a net exporter of caustic soda, but the export volume has decreased significantly since 2017. The export volume in 2019 was about 1.14 million tons, a decrease of 47% compared with 2011. The main reasons are: first, the domestic caustic soda price is high and the export attraction is limited; Second, the demand for caustic soda abroad is limited; Third, India has issued bis certification, which has hindered its export to India.

In 2020, China's top 10 solid alkali exports to other countries and regions will be 316000 tons, and the export countries are mainly Vietnam, Indonesia, Russia, Ghana, Nigeria, Kazakhstan, Djibouti, etc., of which the export volume of the top 6 will not be less than 30000 tons. In 2020, the total volume of the top 10 liquid alkali exports is 539000 tons, and the export volume of liquid alkali is greater than that of solid alkali, among which the export volume of Australia is larger.

June 25, 2023

April 03, 2023

China is a net exporter of caustic soda, and overall, the dependence on caustic soda imports and exports is not high. However, compared to exports, the import volume is too small, so the market...

Liquid alkali: Recently, the domestic liquid alkali market has been mainly stable, and some enterprises have flexibly adjusted their factory quotations based on inventory conditions. In terms of...

Caustic soda industry chain: The upstream is raw salt electrolysis, while the downstream mainly includes alumina, chemical industry, papermaking, textile printing and dyeing, etc. Salt chemical...

Introduction: In 2023, the supply increment of caustic soda in China exceeded the demand increment, and the export performance was weaker than last year. Prices in various markets were mainly...

Email to this supplier

June 25, 2023

April 03, 2023

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.